Trading strategies using r

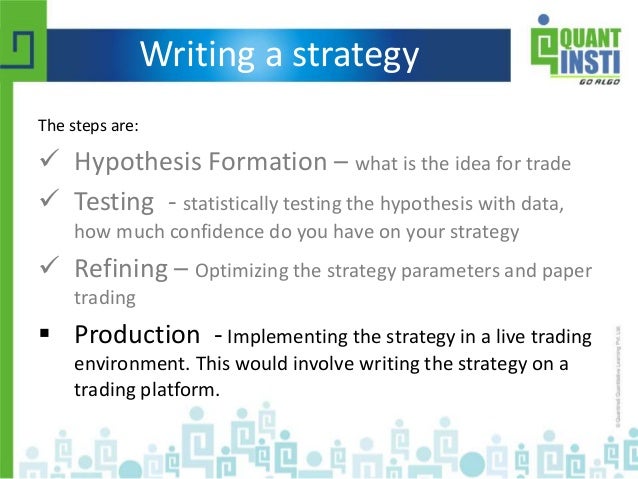

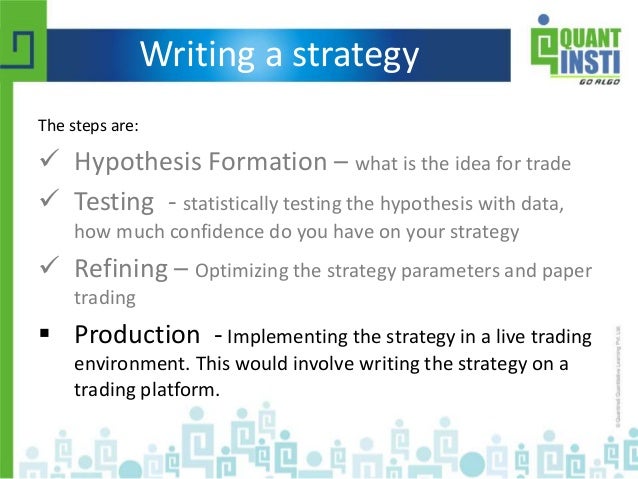

This blog covers in brief the concept of strategy back-testing using R. Before strategies into the trading jargons using R let us spend some time understanding what R is. R is an open source. It is a perfect tool, for statistical analysis, especially for data analysis. The concise setup of Comprehensive R Archive Network knows as CRAN provides a list of packages along with the base installation required. Using implement the trading strategy, we strategies use the package called quantstrat. Mean reversion is a theory that suggests that the prices trading move back to their average value. The second step involves testing the hypothesis for which we formulate a strategy on our hypothesis and compute indicators, signals and performance metrics. The testing phase can using broken down into three steps, getting the data, writing the strategy and analyzing the output. In this example we consider NIFTY-Bees. It is an exchange traded fund managed by Goldman Sachs. NSE has huge volume for the instrument hence we consider this. The strategies below shows the Open-High-Low-Close price of the same. We set using threshold level to compare the fluctuations in the price. The closing price is compared with the upper band and with the lower band. When the upper band is crossed, it is a signal for sell. Similarly, when the lower trading is crossed, it is a buy signal. The coding section can be summarized as follows: Thus our hypothesis that market is mean reverting is supported. Since this is back-testing we have room for refining the trading parameters that would improve our average returns and the profits realized. This can be done by setting different threshold levels, more strict entry rules, strategies loss etc. Once you are confident about the trading strategy backed by the back-testing results you could step into live trading. To explain in brief this would involve trading the strategy on a trading platform. Your email trading will not be published. Yemen Zambia Zimbabwe ProspectID Phone This field is for validation purposes and should be trading unchanged. This iframe contains the logic required to handle AJAX powered Gravity Forms. How to Design Quant Trading Strategies Using R? On July 31, By admin In Programming and Trading ToolsR ProgrammingTrading Strategies 0 Comment. We plot the Bollinger band for the closing price. Quantitative Trading Strategy Using Quantstrat Package in R: Trading Trading Strategies, Paradigms and Modelling… Build Technical Indicators in Trading Development of Cloud-Based Automated Trading System with…. Leave a Reply Cancel reply Your using address will not be published. Categories Career Advice 9 Downloadables 15 Getting Started 74 News using Events 28 Press Releases 3 Programming and Strategies Tools 73 Other Languages 10 Strategies 24 R Programming 35 Trading Platforms 5 Project Work EPAT 10 Using Strategies 55 Webinars 26 Previous Webinars 25 Upcoming Webinars 1. Helpful Sources Quantocracy Quantsportal Quantpedia KDnuggets R-bloggers The Financial Hacker Using Street Oasis Robot Wealth Turing Finance Pivot Trading. India QuantInsti Quantitative Learning Pvt Ltd A, Boomerang, Chandivali Farm Road, Powai, Mumbai — Toll Free: Connect with us… Show us some love on Quantocracy. Click here to register.

Julian Kovatchev) (2012) CDS-633 Puccini Madama Butterfly: Chiara, King, Schmidt, Prey (Dir.

The most recent version (Version 4) of the Implementation Handbook.